Recently, I was intrigued by a fellow horseplayer who claimed you could build a sizeable bankroll with a mere ten-dollar bill.

Now, on the surface, there is nothing controversial about this claim. Heck, you could hit a pick-6 with a two-dollar ticket and build several bankrolls. But let’s dig deeper because this comment strikes at the heart of why so many gamblers lose money.

Money Management vs. Handicapping

Horse bettors, in particular, are fond of claiming their handicapping is great — it’s their money management that keeps them from winning. Yet, 99.9962% of the time their “proof” of this assertion is a series of poor handicapping decisions, not money management errors.

For example, I once heard a guy lament that “he should’ve thrown the eight-horse in the trifecta.”

“I knew that horse was going get there!” He said after the number eight rallied to get third at the wire. “I can handicap, but my money management sucks!”

Uh, sorry, but no. Making betting decisions is part of the handicapping process. If Will the Whiner was convinced the eight-horse was going to finish third, he would have constructed his entire bet around that fact. I mean, seriously: If you knew the winning lottery numbers prior to them being drawn, would you consider it a money management faux pas if you didn’t play them, especially if you played other combos? Of course not. It’s a ridiculous notion.

So, with that out of the way, let’s consider our horseplayer friend who believes it’s a piece of cake to build a sizable bankroll with just $10.

Again, on the surface, this does not appear to be an outrageous claim… if one completely ignores risk. You see, money management is not about who you could have or should have bet — it’s about properly balancing risk and reward.

While it is popular to believe that the best way to beat the races is via a parade of 15-1 shots or $500 exactas, the truth is such a focus is likely to produce an aneurism before it produces next month’s rent.

I — like many others, I’m sure — immensely enjoyed reading Andrew Beyer’s “My $50,000 Year at the Races.” However, I was horrified by the way he achieved his success. At one point in the book, Beyer admits to being down $15K-$20K ($67K-$89K in today’s dollars). If that were me, I’d also be down a family, bald like Beyer (coincidence?), and suffering from nervous tics and incontinence.

The fact is one’s advantage over the game, as defined by the famous Kelly Criterion (a betting optimization method postulated by John L. Kelly in the late 1950s), is a function of one’s success rate and his/her average winning odds.

ADVANTAGE = WIN RATE – LOSS RATE ÷ AVERAGE WINNING ODDS

Hence, it should come as no surprise that both are important. But just in case you’re the stubborn type, let’s look at two mythical bettors — Charlie Chalk and Lorenzo Longshot. Let’s say that, based on a sample of 1,000 races, Charlie and Lorenzo produced the following statistics:

CHARLIE CHALK

Bets: 1,000

Winners: 400

Win Rate: 40.0%

ROI: +10.00%

Avg. Winning Odds: 1.75-1

Kelly Advantage: 5.7% (0.4 – 0.6 ÷ 1.75)

LORENZO LONGSHOT

Bets: 1,000

Winners: 100

Win Rate: 10.0%

ROI: +20.00%

Avg. Winning Odds: 11.00-1

Kelly Advantage: 1.8% (0.1 – 0.9 ÷ 11.00)

Observe that although Lorenzo’s ROI is double that of Charlie’s, the latter has a bigger advantage over the game — by a substantial margin.

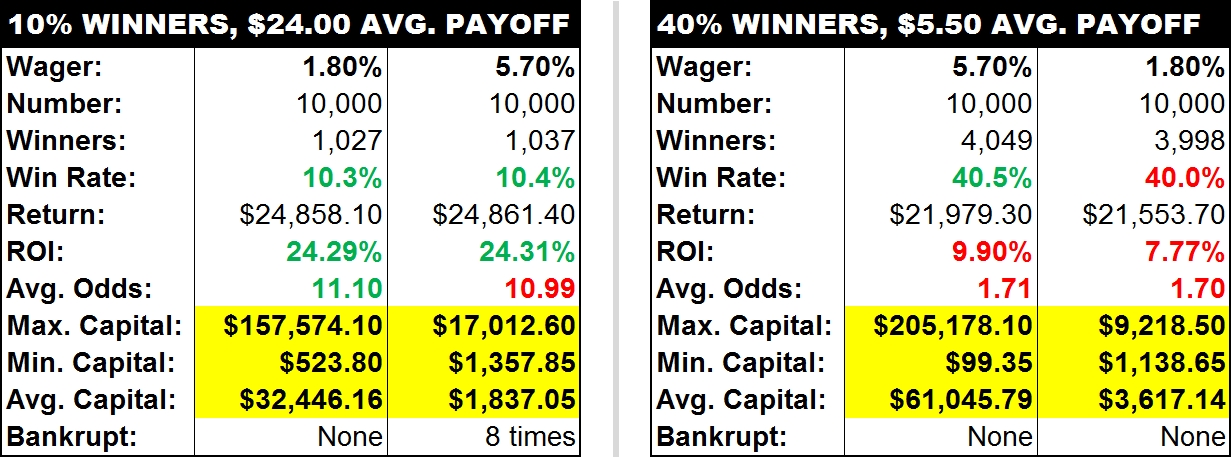

What this means — in dollars and cents — is huge. To demonstrate, I ran 10 random 1,000-race simulations based on the numbers above. Lorenzo’s results are on the left and Charlie’s are on the right:

When betting his Kelly advantage (5.7 percent of capital per race), Mr. Chalk accumulated an average bankroll of $61,045.79 after 10,000 races, handily outpacing the $32,446.16 compiled by Mr. Longshot betting his Kelly advantage (1.8 percent of capital per race). This despite the fact that Lorenzo’s ROI over those 10,000 races was higher than projected (24.29 percent vs. 20 percent), while Charlie’s ROI was lower than expected (9.90 percent vs. 10 percent).

Notice, too, what happened when we switched the Kelly advantages. In the trials that Lorenzo bet 5.7 percent of his capital instead of the recommended 1.8 percent, he went broke more often than Toni Braxton (eight times out of 10, to be exact), whereas Charlie simply made a lot less money than he otherwise might have.

This is why overstating your advantage is one of the worst things you can do when betting for profit… which brings us back to our friend’s claim that one can easily build a sizable bankroll from a 10-dollar bill.

The minimum bet in most horse racing pools is $1-$2, which means, if you are starting with $10, you will be wagering 10-20 percent of your bankroll per race (at least initially).

This is insane! Even if you do manage to get lucky and build your bankroll, the reckless pattern of wagering you’ve established will likely be difficult to throttle down the road.

Do yourself a favor and start with a reasonable bankroll if you’re looking to make consistent money playing the ponies or betting sports. You don’t need thousands of dollars, but you need more than $10.